Let’s start with the news in a nutshell: The Federal Reserve (FED) has lowered the federal funds rate — the interest rate banks charge each other for short-term loans — to a range of 4.25% to 4.5%, down from its previous target range of 4.5% to 4.75%. The decision comes after policymakers slashed rates by 0.5 percentage points in September, followed by a 0.25 percentage point drop in November (Picchi, 2024). Federal effective rates have fallen by a total rate of 1% in just under 4 months, after being on constant increase since February 2022, as shown in the following chart from the Board of Board of Governors of the Federal Reserve System (2024):

Federal Funds Effective Rate (2024)

When the COVID crisis occurred, we saw a sharp increase in interest rates to combat inflation. High federal funds rates usually slow down an economy because they are negatively correlated with investment. Let’s consider the gross domestic product (GDP) equation and include interest rates as a factor affecting investment:

GDP = Consumption + Investment(-interest rates) + Government spending + Net Exports.

Notice how interest rates are negatively correlated with investment, which is the case because money becomes more expensive to borrow. This means that the rise in interest rates since the coronavirus pandemic should have decreased the level of investments and dragged down the economy in the U.S., however, this has not been the case due to several factors, including a robust real estate market and high levels of consumption, which are side effects of low unemployment levels, below 4%. (Mena, 2024)

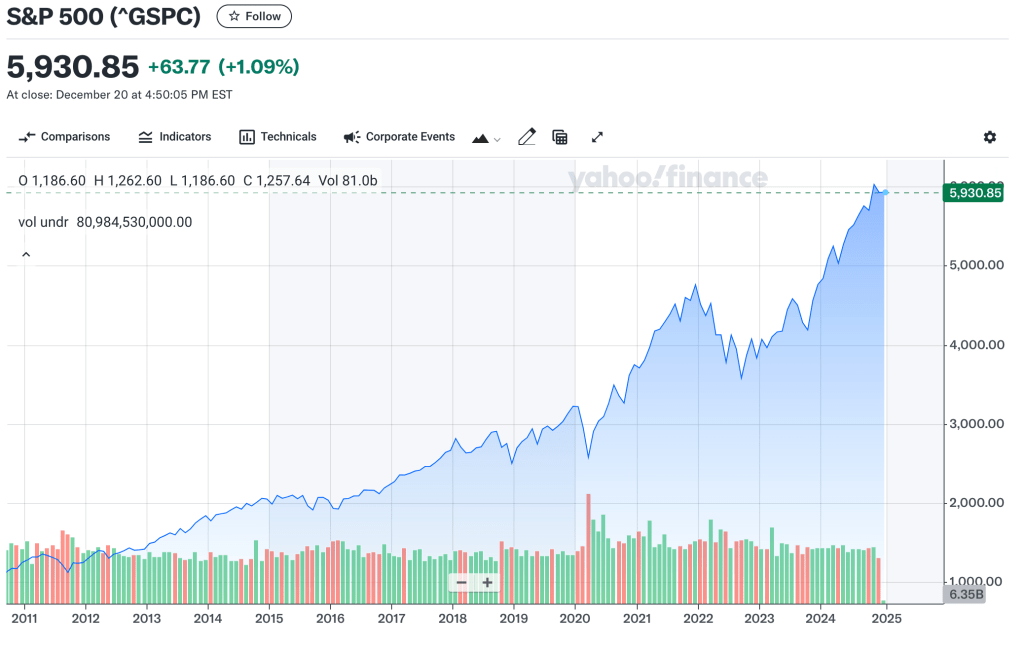

So why is the stock market acting so volatile after this slight cut in interest rates?

Changes in federal funds rates (monetary policy) are not intended to have an immediate impact on the economy but usually take at least 12 months to produce significant effects. However, this is not necessarily the case for the stock market (Seabury, 2024), as it is typically driven by sentiment regarding future economic outlooks and expectations of real earnings after inflation.

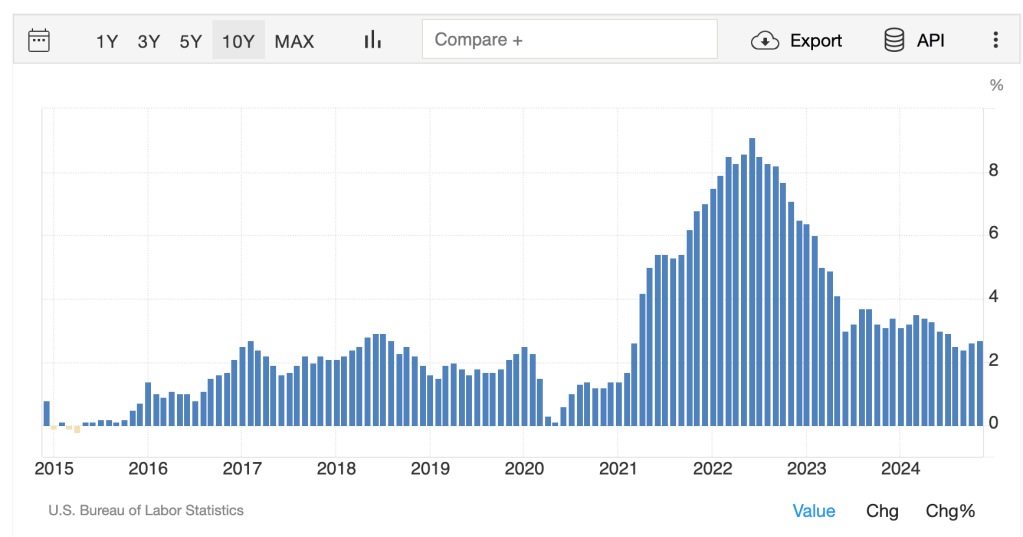

The FED has assumed that inflation rates will continue to stabilize and decline in the coming months, based on the response observed when interest rates were higher in recent years. Since inflation has plateaued at an around 2.5-3% since June 2023 (see chart bellow), it is somewhat risky in the mind of investors for the FED to assume that inflation will reach its 2.0% target without a clear downward trend. However, the FED aims to act ideally years in advance of these changes because an inflation rate below 2.0% would also be undesirable, as people would likely prefer to hold onto their dollars rather than spend them today, which would not be bueno for the economy.

United States Inflation Rate (2024)

In conclusion, The market reacted with significant volatility because the FED announced three rate cuts in just under five months and assumed that the economy will continue growing at a similar passe in 2025. While this might seem ambitious, interest rates remain above 4%, and the U.S. economy has demonstrated resilience, which aligns with the given monetary policy objectives.

In my opinion, these interest rate cuts are not indicative of a potential market recession but rather signal that the government is preparing for sustained economic resilience, which is a positive development. The stock market’s volatility reflects that investors are anticipating a potential shift in trends after several years of consistent growth, but we are likely not at that point yet.

Standard and Poor’s 500, stock market index (2024)

References:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; Available at: https://fred.stlouisfed.org/series/FEDFUNDS (Accessed 22 December 2024)

Mena, B. (2024). ‘Here’s why high interest rates haven’t caused a US recession’. CNN Business, March 19. Available at: https://www.cnn.com/2024/03/19/economy/interest-rates-us-recession-fed/index.html#:~:text=America’s%20economy%20remains%20remarkably%20solid,many%20Americans%20in%20recent%20years. (Accessed 23 December 2024)

Picchi, A. (2024) ‘Federal Reserve cuts interest rates by 0.25 percentage points, but projects fewer reductions in 2025’, CBS News, 18 December. Available at: https://www.cbsnews.com/news/federal-reserve-fed-meeting-interest-rate-cut-decision-december-2024/ (Accessed 22 December 2024)

Seabury, C. (2024). ‘How Interest Rates Affect the U.S. Markets’. Investopedia, 15 October. Available at: https://www.investopedia.com/articles/stocks/09/how-interest-rates-affect-markets.asp#:~:text=The%20change%20in%20the%20federal,response%20is%20often%20more%20immediate. (Accessed 23 December 2024)

Standard and Poor’s 500, stock market index (2024). Yahoo Finance .Available at: https://finance.yahoo.com/quote/%5EGSPC/chart. (Accessed 23 December 2024)

United States Inflation Rate (2024). Trading Economics. Available at: https://tradingeconomics.com/united-states/inflation-cpi. (Accessed 23 December 2024)

US Bureau of economic analysis, United States GDP Growth rates. https://tradingeconomics.com/united-states/gdp-growth (Accessed 23 December 2024)

Leave a comment